Looking Back & Looking Ahead: The Great Growth Race

As we wrap up 2023 and start identifying strategic priorities for 2024, a resounding theme dominates law firm leader discussions: growth. Law firms have never been more keenly focused on growth, and in today’s market, the vast majority of mid-size and large firms are dedicating a substantial amount of leadership time, energy and resources to proactively pursuing growth. One might argue that we have entered the Great Growth Race, a race in which law firms are competing with one another to grab market share, talent, client relationships and practice depth – at a faster rate than their competitors and before those opportunities get scooped up by other firms. This competitive pressure is causing firms to not only better define their growth strategy and key priorities, but also to more proactively and aggressively pursue strategy implementation.

As we wrap up 2023 and start identifying strategic priorities for 2024, a resounding theme dominates law firm leader discussions: growth. Law firms have never been more keenly focused on growth, and in today’s market, the vast majority of mid-size and large firms are dedicating a substantial amount of leadership time, energy and resources to proactively pursuing growth. One might argue that we have entered the Great Growth Race, a race in which law firms are competing with one another to grab market share, talent, client relationships and practice depth – at a faster rate than their competitors and before those opportunities get scooped up by other firms. This competitive pressure is causing firms to not only better define their growth strategy and key priorities, but also to more proactively and aggressively pursue strategy implementation.

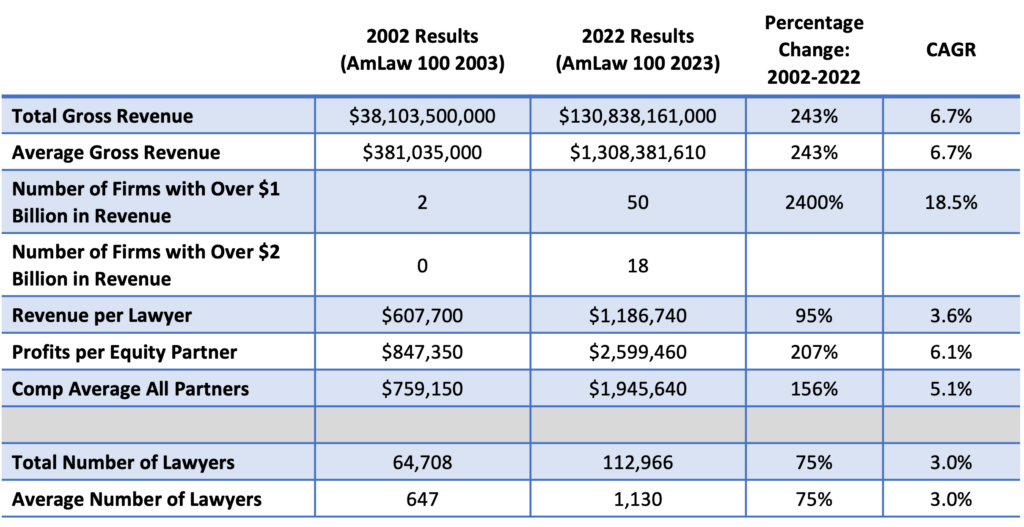

Before we dive into a discussion of future growth, let’s take a look back at law firm growth over the past twenty years. To evaluate the magnitude of growth among firms, we compared the 2023 AmLaw 100 to the 2003 AmLaw 100. In 2003, total gross revenue for all AmLaw 100 firms was $38.1 billion and only two firms reported gross revenue greater than $1 billion, Skadden and Baker & McKenzie. The average gross revenue for the group was roughly $381 million.

Fast forward to 2023 and among the 2023 AmLaw 100, fifty firms reported gross revenue over $1 billion. This number was actually down slightly from 2022 when fifty-two firms reported gross revenue in excess of $1 billion. The average gross revenue among AmLaw 100 firms in 2023 was over $1.3 billion. As one might expect, all other key performance indicators also increased dramatically over the past twenty years as well, including size and profitability.

So what are the most noteworthy observations from this twenty year look? First, AmLaw 100 firms, on average, each added roughly $1 billion in gross revenue during this time period. Although, the average is a bit misleading, as AmLaw 50 firms grew revenue at a disproportionate rate during this time. However, a second, and related, key observation, based on the current trajectory, all current AmLaw 100 firms will likely join the billion (or 2 billion) dollar club in the next 5-7 years, or fall out of the AmLaw 100 and be replaced by firms growing at a more rapid pace.

This remarkable growth in both the size and economics of the AmLaw 100 serves to further perpetuate the Great Growth Race. The legal industry continues to see both consolidation and segmentation pressures by which the big get bigger, and the rich get richer. As large law firms continue to increase both their size and profitability, many of these firms are competing more effectively for clients by demonstrating superior practice or industry depth, bench strength, breadth of related capabilities, geographic reach, and brand recognition. These firms also have the advantage of competing more effectively for talent, attracting attorneys with large practices and niche sub-specialties, through premium compensation.

Given the dynamics of the Great Growth Race, how should firms – big and small – approach setting strategic priorities for 2024? This year’s process for setting strategic priorities does not necessarily differ from prior years – with one exception. As the market continues to get tighter, the need for clarity around strategic focus and prioritization of investment will only intensify. Regardless of size and growth trajectory, firms must take a hard look at where they compete in the market, define a strategy which plays to their strengths, prioritize investments to build on those strengths, and take action to implement.

Be Specific About and Play to Your Strengths: Few, if any, law firms can legitimately claim to beat out competitors by attempting to be all things to all people. When firms define the practices or industries they are strongest in, and where they can most effectively compete for profitable client work, they are better positioned to develop strategies that lean into and grow those practices and industries of particular strength. This, in turn, helps firms to remain competitive and win more work, even when these firms may not be the largest.

Prioritize Investments: Like most businesses, law firms face limits on the availability of internal resources, and despite the desires of many law firm partners, firms simply cannot invest in everything at once. Compensation dollars, leadership time, business development resources, and lateral hires all represent scarce resources. And because such resources are limited, law firms must choose: Which practices, industries, geographic markets, or other opportunities represent the best strategic investments? By identifying and focusing resources on the areas that offer the greatest current and future market opportunity and that also most effectively leverage the firm’s core strengths, the firm’s investment in pursuing strategic priorities is more likely to deliver the desired result and improve the firm’s long-term competitiveness.

Follow Through: In today’s rapidly consolidating and segmenting market, there is no room for firms to drop the ball on implementation. Pursuing strategic objectives can be both challenging and frustrating at times, and producing results requires a true leadership commitment and dogged follow through. Firms must hold leaders and partners accountable for taking bold action to pursue strategic objectives for 2024 and beyond.

_______________________________________________

The coming years will undoubtedly see ongoing consolidation and competitive pressures, as an increasing number of firms join in the Great Growth Race. To effectively combat this pressure, now is the time for firms to step back and ensure that they have clearly defined their growth strategy, are investing sufficient resources in high priority growth areas, and taking bolder action to implement strategic and growth goals.