Successful Mergers

Despite the multitude of mergers over the last 2 decades, the legal market remains much less consolidated than other professional service sectors. The top 10 investment banks, accounting firms and advertising firms hold a much greater share of their overall markets than the top 10 law firms do of the legal market. While there are some natural barriers to consolidation in the legal industry – conflicts chief among them – it is likely that the market will continue to consolidate for the foreseeable future.

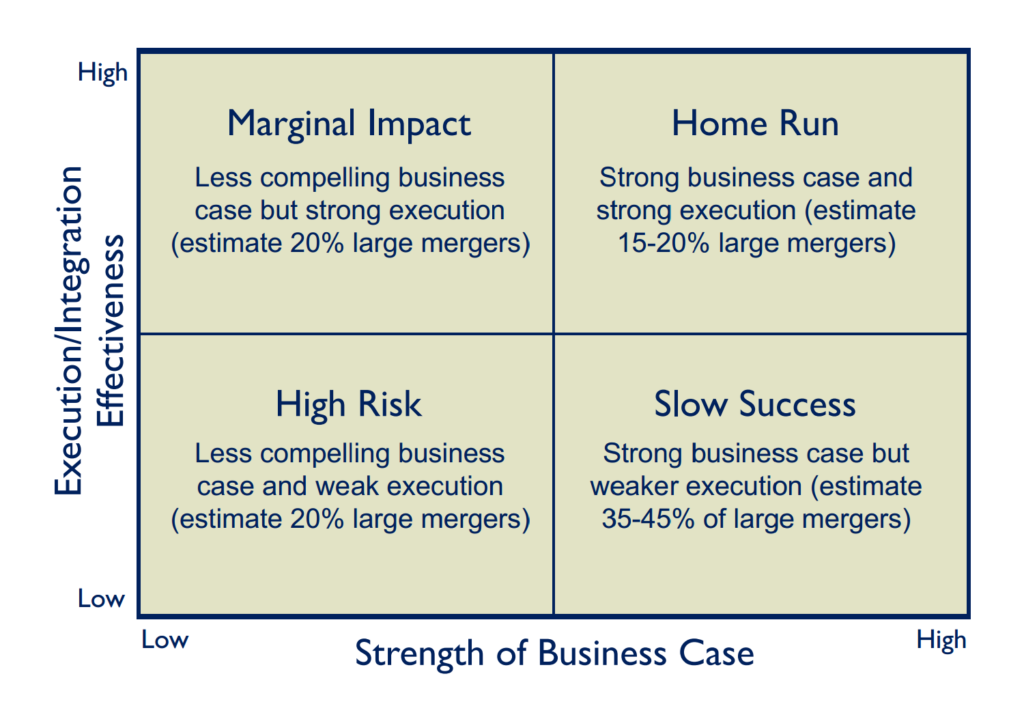

While law firm mergers have become increasingly common, the outcomes of mergers are decidedly more varied. Many have been successful, while some have been spectacularly unsuccessful (to the point of firm dissolution). Some have exceeded expectations, while others have had little impact on the overall competitiveness of the combined firm. Our experience, having consulted on many mergers over the last two decades, indicates that there are two key determinants of success. The first is the strength of the business case for the merger. The second is the effectiveness of execution and integration (see diagram). A weak business case for merger is unlikely to result in significant success even with flawless execution. Likewise, we have seen some combinations with very strong business cases fail to realize their potential or do so far more slowly than desired because execution was weak or an afterthought.

Building a business case for merger

The business case for merger starts with a clear strategy. This should focus primarily on the merged firm’s desired market position, the basis of its competitiveness and differentiation in the marketplace, and the target client base. The strategy should also address internal factors including talent management priorities and cultural underpinnings. Fundamentally the business case needs to establish how the combined firm will be more competitive in the market and can better service existing clients and/or win new clients and work that neither firm could attract independently.

For example, two firms which are able to achieve or solidify a market leading position in a particular area of practice have a strong case for merger. Or which are able to combine complementary practices with compatible client bases and a high likelihood of being able to cross-service. Or which share key clients or have compatible industry strengths that create a market leading position. There are less obvious business cases that can also result in successful mergers. Typically these are firms which are starting down the path of building market profile and may need a series of building blocks to achieve success. Such mergers understandably require particular emphasis on effective execution.

The business case must address not only the current position of the combined firm, but the likely position in the rapidly evolving market. For a merger to drive real long term value, the business case must reflect a strategy defining how the firm will out compete the market, both in the near and longer term.

Effective Merger Execution

The key to effective merger integration is to ensure a balance between client, practice and people integration on the one hand and administrative and structural integration on the other. Too often the administrative integration becomes the primary focus, and the client, practice and people side is left to its own devices. While the firm may ultimately achieve its expected objectives with such an approach it is likely to take five years instead of two. The true success of the merger will not be measured by the immediate compatibility of the voicemail system but instead by the ability to deliver on the potential identified in the business case. This can include, for example, delivering on a competitive strength, delivering integrated services to clients across jurisdictions, and winning new clients and work.

Effective planning of merger integration is critical. It helps to establish the roadmap and expectations while enabling the leadership of the firm to delegate where appropriate and focus on the most value added initiatives. Too often the leadership gets caught up in the minutiae and then doesn’t have adequate time to address the important issues. This is not meant to diminish the importance of getting the small details right. But the big things will be the ones that make the long-term difference.

- Integration planning can be organized around 6 key work streams:

- Clients – including client relationship management programs and business development

- Practices and Processes – including practice group integration and practice group planning

- People and Culture – including alignment of performance expectations and HR policies

- Management and Organization – including alignment of governance and practice structures and consistency in communications

- Infrastructure – including integration of key functions and identification of cost saving opportunities

- Finance – including establishment of key metrics, alignment of financial systems and reporting, and integration of pricing, billing and collection processes

Throughout integration it is vital that lawyers maintain focus on providing exemplary service to clients. The merger should enhance client service, not distract from it, and client perceptions formed in these early days have a lasting impact.

Conclusion

We expect merger to continue to play a significant role as the legal industry consolidates globally. In order to increase the percentage of ‘Home Run’ mergers, the focus has to be on ensuring that there is a genuinely strong business case for the merger, and that the post-merger integration is well planned and effectively executed. Too few mergers historically have succeeded on both of these dimensions and the market is less forgiving today than it was a decade or two ago.