The Amlaw 100: Averages Don’t Tell The Whole Story

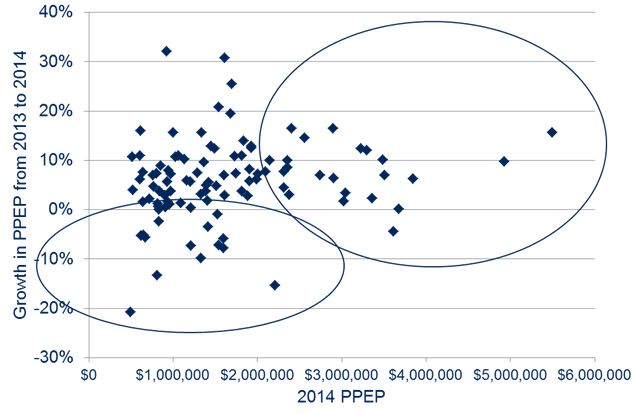

The following chart shows where each AmLaw 100 firm’s 2014 PPEP stood relative to each firm’s percentage growth in PPEP from 2013 to 2014.

The results are interesting, and include:

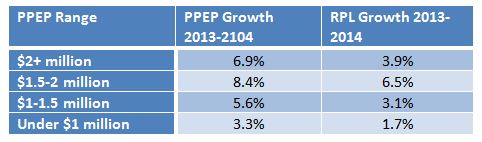

- The 26 most profitable firms, whose PPEP is above $2 million (generally those in the right hand circle on the chart), grew profits per partner at an average rate of 6.9%. Only two of the firms in that group experienced a decline in profitability, and those declines appear to be aberrations. This group of firms grew PPEP while also growing their equity partnerships by 1.2%, so are not driving PPEP simply by managing their equity ranks.

- The next most profitable group, those with PPEP between $1.5 and $2 million, had an even greater rate of growth at 8.4%, although the average was pulled up by a few firms with 20+% growth. This group held their equity partnerships basically flat, with -.1% change.

- The most challenged, and variable, group were the firms with PPEP under $1 million, whose PPEP increased 3.3% on average but includes firms from -21% to +32% change in PPEP. Six of these 31 (19%) firms experienced declines in PPEP.

The 2014 performance of firms continues a trend of significant profitability segmentation. Because the base profits at the most profitable firms are so much higher, the growth in dollars is even more dramatic and serves to drive the wedge between the highest performing firms and everyone else. The most profitable group ($2+ million) grew profits by an average of $192,000 per partner over the one year period, while the firms under $1 million added an average of $22,000 per partner. While one could certainly argue that all Am Law 100 firms are doing very well, the rich firms are indeed getting richer and widening the gap every year. The most profitable firm in this year’s AmLaw 100 earns 11 times as much per partner as the 100th firm. These dynamics play out in other global markets as well.

While the results are interesting, the real questions are around what is driving the performance gaps and what the implications of these profitability trends are. Not surprisingly there was a connection between growth in revenue per lawyer and growth in profits per equity partner (see chart below) and it is in part a pursuit of higher revenues per lawyer that drives real profitability in large law firms.

Revenue per lawyer is a reflection, firstly, of how clients value the firm’s services. It essentially translates into how much clients are willing to pay for the firm’s services and how much of the firm’s services they are willing to buy. As the client demand for legal services from large law firms globally remains relatively flat, clients are in the driver’s seat and firms must align value with the cost of services. The firms who are able to provide superior value in the eyes of the client (which will be defined differently depending on the nature of the matter) will be in demand.

Secondly, it is reflection of the firm’s management of its resources and the strategic decisions it makes. Revenue per lawyer reflects the firm’s mix of practices and often its geographic footprint. In other research we have done we have seen that strategic focus and being “known for” a practice or practices or an industry/sector is a strong driver of revenue per lawyer and profitability. By contrast, among AmLaw 100 firms, size and profitability have almost no correlation.

Revenue per lawyer also reflects the productivity of the firm’s lawyers and the effectiveness of the firm’s performance management. Partner productivity dropped substantially post-recession and has really never recovered. While certainly billable hours are not the only measure of a partner’s value to the firm, many managing partners report that they have excess partner capacity in the firm. One recent survey reported that 61% of managing partners indicated that overcapacity is bringing down profitability (AmLaw Daily, May 12, 2015).

Effectively managing partner performance and productivity is key to growing revenue per lawyer (and therefore profits). It is important to remember that revenue per lawyer can be impacted by the firm’s leverage model – firms with a high partner mix (and resulting lower leverage) may have high RPL that does not drive profitability. The most successful firms are those who can achieve an appropriate balance of leverage and revenue per lawyer growth.

We expect the profitability variability, with some firms doing very well and others struggling, to continue in 2015 and beyond. This creates some instability in the market, which increases lateral movement and may result in some firms dissolving. Lateral movement will likely accelerate as partners look to join not just more profitable firms, but firms that are “known for” their area of practice and a destination for clients. Firm management needs to be aware of the market dynamics and make the strategic and performance management decisions that will ensure the firm’s success long term.